Aspen, Snowmass & Beyond: Year-End Insights Across the Valley

When we look back on 2025, the Roaring Fork Valley real estate market stands out for one simple reason: it remained remarkably steady while much of the country searched for its footing. While national headlines have focused on cooling demand and pricing pressure, the data across Aspen, Snowmass Village, and the broader valley tells a far more nuanced story.

This year-end analysis draws from Aspen Snowmass Sotheby’s International Realty’s Q4 2025 Market Report, offering a holistic view of luxury, mid-market, fractional, and land trends shaping the region.

Market-Wide Perspective: A Shift From Volatility to Discipline

Across the Roaring Fork Valley, 2025 felt like a return to something more familiar, a market guided less by urgency and more by long-standing supply and demand dynamics. Transaction volume normalized, price growth moderated to sustainable levels, and inventory constraints continued to define buyer and seller behavior.

This environment has reinforced a key reality: supply scarcity remains the dominant driver of long-term value.

Market Leadership Across the Roaring Fork Valley

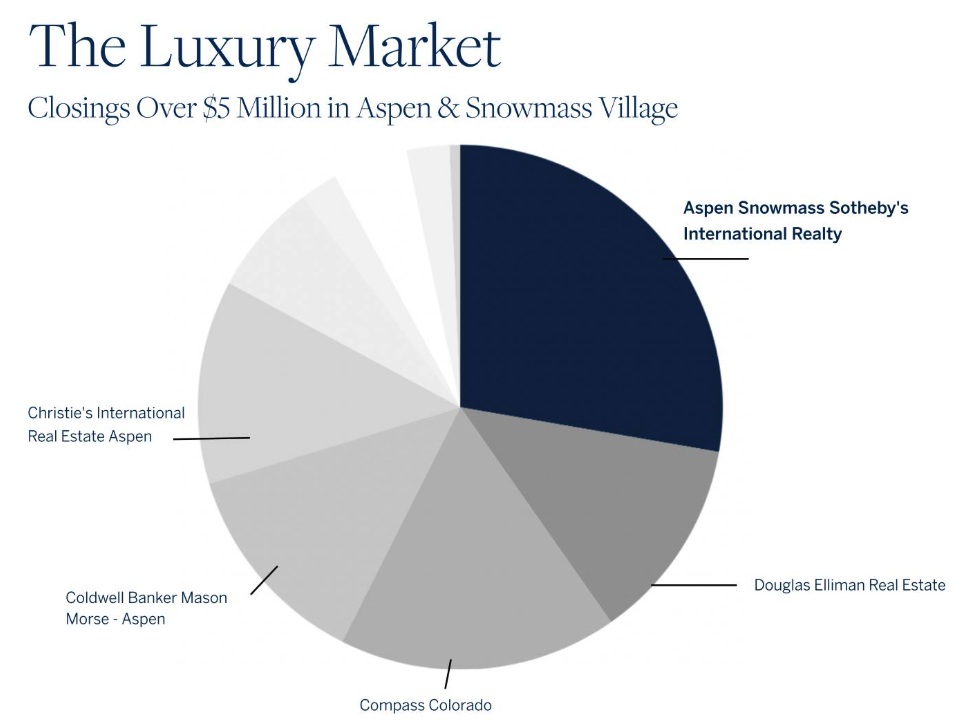

Market share is one of the clearest indicators of sustained performance in a supply-constrained environment like the Roaring Fork Valley. In 2025, Aspen Snowmass Sotheby’s International Realty once again led the market in both total dollar volume and high-value transactions, reflecting consistent execution across the valley.

Aspen Snowmass Sotheby’s International Realty has been the #1 real estate firm in the Roaring Fork Valley for over 20 years, leading all brokerages in total transaction volume and market share across all price points.

In the $5M+ segment, Aspen Snowmass Sotheby’s International Realty continues to command the largest share of high-value closings in Aspen and Snowmass Village.

Aspen Real Estate Market Overview

Aspen delivered a nearly identical transactional year to 2024, with approximately 185 total residential and land sales and over $2 billion in dollar volume.

Pricing Trends & Market Signals

- Average single family homes pricing dipped slightly, down 6% YOY, and averaged nearly $19M

- Average condo pricing remained elevated, averaging nearly $6M

- Price per square foot increased year-over-year across both property types, signaling continued price support despite slower growth

Inventory & Negotiating Power

- Active inventory increased modestly, yet remains historically constrained

- Sellers retained negotiating leverage, with average list-to-sale discounts around 6.5%

Snowmass Village: A Maturing Luxury Market

Snowmass Village continued its evolution from “Aspen alternative” to a standalone luxury destination.

Key Market Dynamics

- Single-family home sales were slightly reduced at 1% down YOY

- Condo and townhome statistics were skewed by 2024 Base Village construction deliveries

Pricing Momentum

- 2025 marked pricing exceeded $2,000 per square foot for single-family homes

- Condos are averaging slightly below single-family homes per-square-foot rates

Inventory Constraints

- Fewer than 20 active single-family listings for much of the year

- Seller leverage remains strong, with sub-5% average discounts

Fractional Ownership: A Strategic Entry Point

The fractional market posted solid year-over-year growth across both Aspen and Snowmass Village.

Why Fractionals Matter

- Rising average sale prices, +19% YOY

- Shorter days on market, YOY

- Increased transaction volume, YOY

Fractional ownership has become an increasingly smart and flexible way for buyers to establish a foothold in Aspen and Snowmass, without the full commitment of whole ownership. It’s a great investment, particularly as luxury buyers diversify usage.

Woody Creek & Old Snowmass: Volume Growth Amid Price Normalization

In markets like Woody Creek and Old Snowmass, year-over-year swings often say more about sample size than sentiment, and buyer interest remains very real. These ultra-low-density, high-net-worth submarkets experienced significant increases in transaction volume in 2025.

Market Interpretation

- Average prices fluctuated due to small sample sizes

- Sales activity increased meaningfully, +48% YOY

- Buyer interest remains strong for privacy-driven, estate-style properties

Basalt, Carbondale & Glenwood Springs: The Valley’s Growth Engine

Mid-valley markets played a critical role in 2025, absorbing demand from:

- Local families

- Remote professionals

- Buyers priced out of Aspen and Snowmass

Notable Trends

- Carbondale and Glenwood Springs saw double-digit gains in average pricing and dollar volume

- Days on market remained efficient

- Inventory remains tight relative to demand

These communities continue to anchor the valley’s economic and demographic stability.

New Castle & Silt: Affordability and Absorption

At the more attainable end of the market, New Castle and Silt demonstrated:

- Healthy absorption rates

- Modest price growth or stabilization

- Strong relevance for first-time and workforce buyers

These markets remain essential to the broader Roaring Fork Valley ecosystem and future housing balance.

The Land Report: Scarcity Beneath Every Segment

Residential land trends reinforce the structural constraints underpinning the entire market.

Key Takeaways

- Land inventory increased year-over-year, but from very low levels

- Transaction volume rose, while pricing remained resilient

- Zoning regulations and construction timelines continue to suppress new supply

In Aspen and Snowmass Village particularly, land scarcity remains one of the strongest long-term value drivers.

A Local Perspective on the Year Ahead

Andrew Ernemann, CEO & Partner

The wild ride that began with the post-COVID blitz has rolled into a steady market that still favors sellers overall (although there are definitely exceptions that show up from time to time).…

..I am not one to make predictions so I’ll refrain once again, but I keep hearing others in the real estate industry talk about their optimism for 2026 – this isn’t necessarily a good thing! I do know that fundamental supply/demand ratios and a disciplined numbers-based lens points to continued price increases in the near-term. I also know that the agents operating consistently at the top of our market are busy, and they have solid pipelines of buyers looking to get into the local market. The local real estate market often swings in a similar direction to wealth generation in equity markets, it will be interesting to see if this correlation continues in 2026!

Leave a Reply